COVID-19 segments: Where are they now?

As we continue to weather this pandemic and watch the world slowly reopen around us, we're keeping a close eye on how consumer attitudes and behaviors continue to shift.

Unstable environments mean fluid segments

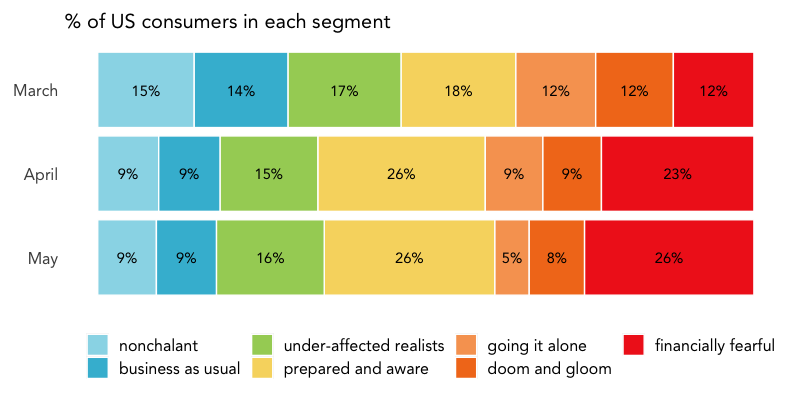

In March, we surveyed and classified over 1,000 respondents into our custom COVID-19 consumer segmentation: seven distinct consumer groups representing a range of reactions, from feeling the virus is overhyped to having grave concerns about making it through this difficult time. These seven segments are arranged on a continuum from least to most concerned:

We generally treat segmentation research as foundational work that can inform businesses for several years. However, given the pandemic's ever-changing social and economic environment, we hypothesized that our COVID-19 segmentation would reflect the rapid-paced instabilities around us. We decided to track how the attitudes — and proportions — of our segments change over time. A five-question typing tool was developed for classifying consumers into the seven segments, ensuring 80% overall typing accuracy, and was fielded in April and again in May. We'll be collecting responses to assess how sentiment is changing in June.

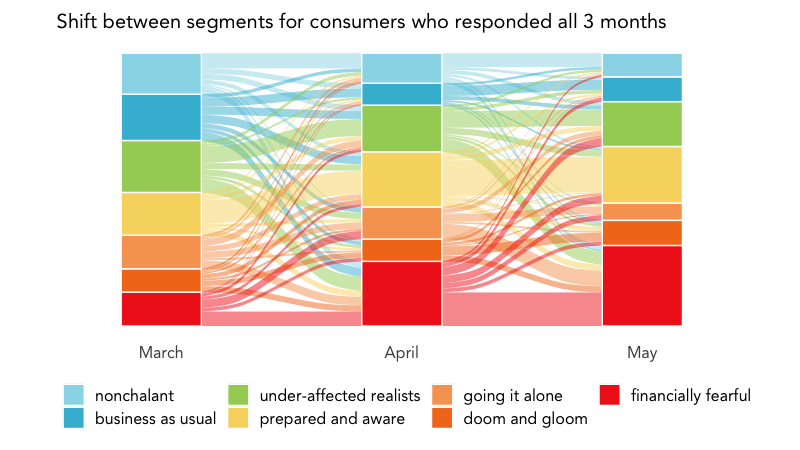

Our hypothesis was correct. Among over 950 respondents classified in both March and April, we saw two-thirds of respondents change segments. As expected, the lack of stability and continued uncertainty we're experiencing as a nation contributed to remarkable shifts among these segments. However, though we continue to see increases in the most concerned segment, we saw less shifting in the most recent fielding, which occurred as states began to reopen. In the May fielding, just over half of respondents changed segments.

March to April: Concern continued to grow amid uncertainty

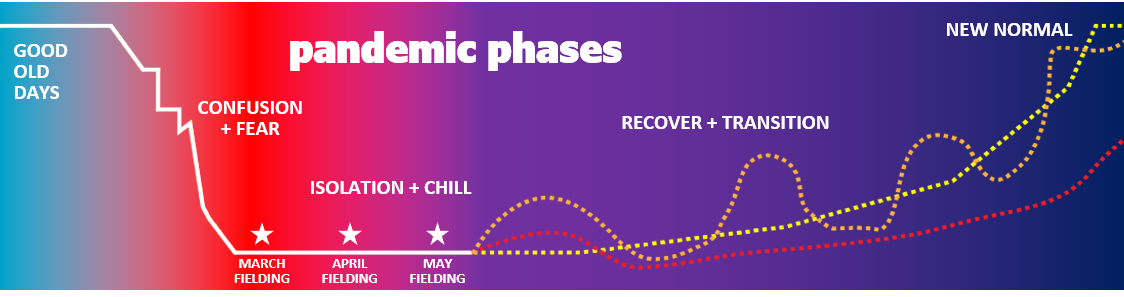

From the pre-pandemic days to our quest to find a New Normal, we've evolved through a series of general phases:

Our initial fielding took place at the tail-end of the Confusion + Fear phase and the beginning of the Isolation + Chill phase, while the April fielding occurred in the middle of Isolation + Chill. Overarching behavior trends in the April time frame show panic buying and supply chain interruptions finally beginning to decrease, with many experimenting and becoming more comfortable with alternative solutions that work for them during this period of social distancing, distance learning, and working from home or unemployment.

As such, consumers were seeing real-life impacts of the pandemic, and we saw the greatest growth in the Financially Fearful segment; the most concerned segment on the continuum.

Among all six of the other segments, consumers who changed segments were most (or equally) likely to shift to the Financially Fearful segment from March to April. The two least concerned segments saw the most change, with consumers often jumping to the furthest and most concerned segment (Financially Fearful) or "stair-stepping" up the continuum as concern gradually increased.

This makes sense.

Between March and April, we began hearing terminology like "another Great Depression" as the US economy fell into a deeper recession. Unemployment spiked to 26 million during the second fielding. More respondents may have lost jobs or experienced reduced wages since the first fielding.

The other four segments (in the middle and more concerned right-hand side) saw shifts in both directions. While many grew more concerned, there were some who went back on the continuum toward less concerned (though very few shifted as far back as the first two segments). These are likely consumers who became "spent" on stress and were already working to accept the new reality. The second fielding also coincided with the first wave of stimulus checks, which may have helped assuage some fears.

April to May: Segments begin to show stabilization

The May fielding period occurred towards the tail-end of Isolation + Chill, as many states made plans for phased reopening. During this time, we observed continued experimentation from consumers giving serious consideration to the behaviors and solutions they'd like to carry forward versus those that will be abandoned as routines are restored or new alternatives are developed.

Although the Financially Fearful segment continued to grow, now comprising more than one-fourth of the population, the segments were more stable between the second and third waves. Still, about half of the respondents shifted segments. In particular, 77% of consumers classified as Going it Alone in April were reclassified in May. Nearly half shifted to Financially Fearful, indicating that these consumers continue to be negatively impacted and should be a focal point for companies wishing to improve the lives of their customers.

Finding hope during a pandemic

While there's still a healthy amount of fear and uncertainty, it has not continued to grow exponentially. Now that the stock market seems to have regained the loss experienced from the initial recession and — based on recent job reports — unemployment has bottomed out, we expect stability to increase, or we expect to see consumers reclassified into less concerned segments. Though some segments struggled more than others to identify positive changes made as a result of COVID-19, a shared refrain prevailed: the gift of time. Many identified positives like more time with partners and children, for self-care, and for checking off items on a "rainy day" list:

"Spending more time keeping in touch with family and friends and not taking them for granted."

"Cleaned closets and got into gardening and landscaping! Took time to enjoy the small things!"

"Lost a bit of weight! Perfected my painting techniques on furniture, finished all of Philip Roth's works."

As states reopen and more Americans return to work, we're optimistic that the most concerned segment will shrink again. We are preparing for a June fielding of the typing tool and will continue to monitor changes monthly. As researchers, our objective is to keep you informed throughout the summer. Stay tuned and learn along with us, or go a step further and ask your own consumers how they've been impacted, how they're adjusting, and how you can help.

- covid-19

- segmentation

Topics

Get the pandemic personas at your fingertips

Get the pandemic personas at your fingertips

Download our PDF for insight on the seven segments of consumers we identified based on their reactions to the COVID-19 pandemic. Get a detailed breakdown of the segment profiles and learn more about how consumers' attitudes and behaviors have shifted since March.